2026 Budgeting Template

The 2026 Cannabis Budget Template: Built for Compliance, Designed for Clarity.

Stop struggling with generic spreadsheets. This budget template was created by a Cannabis Tax Strategist to solve the industry's most complex financial hurdles and give you a clear, actionable roadmap for your business.

What Makes This Template Essential for Your Business?

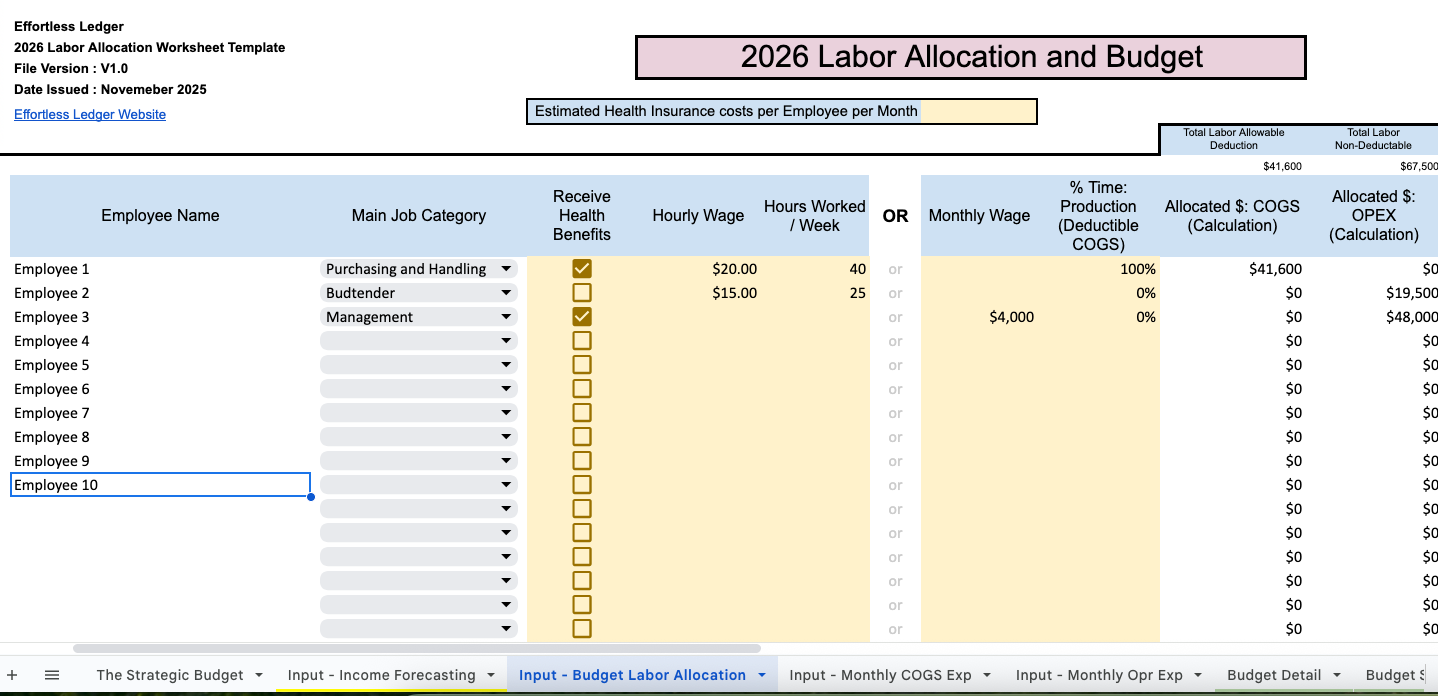

Four Dedicated Input Tabs: Effortlessly enter your projections across Income Forecasting, Labor Allocation, COGS Expenses, and Operating Expenses.

Automated Financial Reporting: All input seamlessly flows into two powerful outputs: a Detailed P&L and a concise Summary P&L (Profit & Loss).

IRS 280E Ready: Includes two specialized tabs focused exclusively on compliance:

Labor Allocation: Easily designate the percentage of employee time dedicated to production (deductible COGS) vs. management (non-deductible).

Expense Separation: Clear segmentation between your Deductible COGS Expenses and Non-Deductible Operating Expenses to safeguard your tax position.

Strategic Structure: Start with a step-by-step methodology to ensure your budget is a strategic management tool, not just a compliance document.

Get your free, editable copy now and take control of your compliant growth.

Enter your email for your free Excel template and to join our cannabis accounting updates newsletter

Budget Planning Checklist

-

✺ Strategic Mindset Shift (The Foundation)

Reflection: Conduct a post-mortem on 2025: What institutional waste is funded? (Ask: "Would we spend this money if we started today?")

Vision Alignment: Define the top 3-5 strategic goals for 2026.

Allocation vs. Projection: Ensure every dollar is tied to a specific 2026 goal (e.g., Marketing $X for Product Y launch).

-

✺ METHODOLOGY & DATA GATHERING

Choose Method: Select Zero-Based Budgeting (ZBB) for growth/efficiency, or Incremental for stable operations.

Gather Historical Data: Collect clean, segmented 2025 actuals (exclude one-time anomalies).

Department Inputs: Require detailed, justified proposals from all department heads (especially if using ZBB).

-

✺ REVENUE FORECASTING

Historical Anchor: Establish a clean, repeatable 2025 revenue baseline.

Market Reality Check: Integrate external market growth projections. If your forecast exceeds the market, justify the difference with specific strategy/action.

Pipeline Model: Weight revenue based on the current sales pipeline conversion probability (e.g., 80% likelihood).

-

✺ FINALIZING AND APPROVAL

P&L Consolidation: Finalize the 12-month P&L model, ensuring monthly inputs sum correctly to the annual budget.

Cash Flow Review: Verify the budget's impact on liquidity (when cash comes in vs. when bills are due).

Management Sign-Off: Obtain final, formal approval from the CEO/Owner to lock in the plan.

-

✺ TRACKING & GO-LIVE (The Real Work)

Monthly Reporting Schedule: Set a date (e.g., 5th business day) for monthly budget review meetings.

Variance Analysis: Review all budget variances monthly. Document the reason for the variance (controllable vs. uncontrollable).

Run Rate Tracking: Track the annual run rate (current performance annualized) and flag any line item that falls below target for immediate strategic adjustment.